Quantitative Easing Explained: Who Really Benefits?

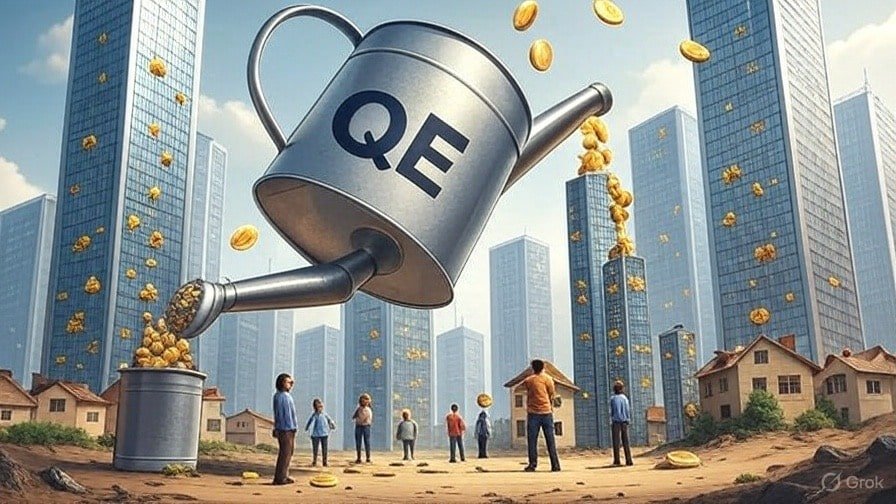

Quantitative easing, or QE, is the central bankers’ favourite trick when the economy is in trouble. It sounds complicated, but at its core it’s simple: the central bank creates new money and uses it to buy government bonds and other financial assets.

The promise is that this will lower interest rates, encourage lending, and boost growth. But has it really worked — or has it mainly served to protect those who already benefit most from the system?

Table of contents

What QE Actually Does

When the central bank buys up bonds, the price of those bonds goes up and their returns (yields) go down. Investors, unhappy with low returns, shift their money into stocks, property, and other assets.

At the same time, cheap borrowing should make it easier for households to get mortgages and for companies to take out loans. And because the central bank looks like it’s standing behind the market, confidence rises.

On paper, this is supposed to kick-start the economy.

The Reality: Asset Prices Soar

The effect is obvious: QE pushes up stock prices, bond prices, and property prices. That’s great for those who already own them. Investors feel richer, companies can buy back shares, and homeowners see their property values rise.

But for those without assets, the picture looks very different. House prices climb out of reach, rents rise, and savings accounts yield next to nothing. The gap between those with wealth and those without only widens.

Why Lending Doesn’t Take Off

The official story is that QE fills banks with money to lend. But banks don’t lend just because they have reserves. They lend when businesses and households want to borrow and can repay. If people are cautious or already drowning in debt, the demand simply isn’t there.

So, much of that money sits in the financial system rather than flowing into everyday wages, jobs, or small businesses.

The Winners and the Losers

Winners:

- Investors and asset holders, who see their wealth rise.

- Governments, who can borrow more cheaply.

- Big corporations, who enjoy low-cost debt.

Losers:

- Savers and pensioners, who get little return.

- Young households trying to buy their first home.

- Ordinary workers, who rarely see their pay rise in step with soaring asset values.

Why QE Was Chosen

Critics argue there were alternatives. Instead of funnelling money through financial markets, central banks and governments could have:

- invested directly in infrastructure and green projects

- supported small businesses

- even given households direct cash (“helicopter money”)

These options might have boosted the real economy more directly. But they also would have shifted power and wealth in ways that threatened the financial elite.

So QE was chosen — a policy that looks technical, reassures markets, and, most importantly, keeps the status quo intact.

QE and the status quo

Quantitative easing is sold as a cure for economic stagnation. In reality, it has been a lifeline for financial markets and asset holders. It didn’t fix long-term problems or deliver shared prosperity.

It kept the system stable, yes. But it also entrenched inequality and made sure the winners stayed winning.

In the end, QE tells us more about who central banks really serve than about how to build a fair recovery.

Would you like me to now also add the SEO package (focus keyword, meta description, and JSON-LD FAQ schema), so you can drop this straight into your site?