Why Value Investing Makes ESG Look Like a Scam – Opinion

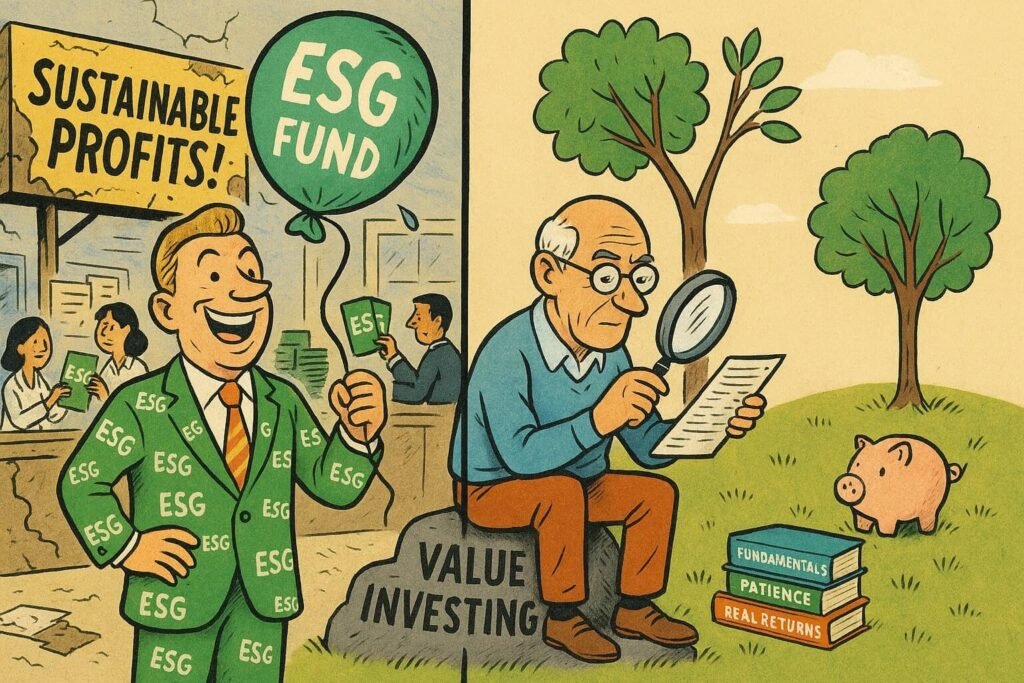

ESG investing was sold as a revolution. Ethical returns, sustainable profits, a greener and fairer capitalism. But peel off the glossy label and it’s the same old supermarket carrots — just repackaged, priced higher, and marketed as “organic.”

Meanwhile, the old-school approach everyone forgot about — value investing — keeps chugging along. Boring, disciplined, and honest. And here’s the punchline: it beats ESG both financially and morally.

Table of contents

ESG: All Image, No Substance

ESG isn’t ethical — it’s a corporate PR machine.

- Fire half the workforce, outsource the rest to a sweatshop, jack up prices. Doesn’t matter.

- Plant a few trees, write a diversity report, announce a vague carbon pledge — congratulations, you’re “responsible.”

ESG is a shield, not a solution. It lets corporations look virtuous while changing nothing of substance.

Green Labels, Same Profits

Crack open a typical ESG fund and what do you see? Tech monopolies, oil companies with “net zero” slogans, banks with colourful pledges.

Why? Because ESG doesn’t challenge capitalism; it monetises morality. It’s a sticker slapped on the same product, sold back to guilt-ridden investors at a premium.

The Real Danger

ESG lets investors feel ethical without thinking. Don’t bother checking the balance sheet — just trust the ESG score. Lazy investing, dressed up as virtue.

This is exactly what corporations want: less scrutiny, more box-ticking. A free licence to keep running business as usual, but with applause from the ESG chorus.

Value Investing: The Boring Hero

Value investing doesn’t care about buzzwords. It looks at:

- Business model

- Leadership

- Profitability

- Price

It’s dull. It’s old-fashioned. It doesn’t pretend to save the world. But it works — because it’s based on reality, not slogans.

Ironically, that’s where real “ethical” investing lives. In clear thinking, not branding rituals.

ESG vs Value: One Obscures, One Reveals

- ESG asks: How does this company look on paper?

- Value asks: How does this company actually work?

- ESG rewards: What companies say.

- Value rewards: What companies do.

One infantilises investors with a feel-good shortcut. The other treats them like adults capable of long-term thinking.

Who Really Wins with ESG?

Not the planet. Not workers. Not society.

The winners are:

- Corporations — who look virtuous for cheap.

- Consultants — who get endless ESG contracts.

- Fund managers — who charge higher fees for the same product.

It’s morality sold by the kilo.

Discipline Beats Branding

ESG is capitalism in costume — a scam wrapped in slogans.

Value investing is capitalism unmasked — boring, disciplined, effective.

One hides reality. The other understands it.

And that’s why, in the long run, value investing will always beat ESG — not just financially, but morally.

👉 Want the full story on how virtue became a business model? Visit our ESG Explainer Hub to see how finance, branding, and compliance turned morality into a market.

FAQ

Q1. Why is ESG controversial?

Because it mixes finance with politics, selling “virtue” without reform.

Q2. What is value investing in plain English?

Buying solid businesses at fair prices, holding them long-term. No branding, no box-ticking.

Q3. Who benefits most from ESG?

Corporations, consultants, and asset managers — not society or investors.

Q4. Does value investing count as “ethical”?

It doesn’t pretend to be, but by rewarding real discipline over empty slogans, it often is.